The Ultimate Guide To Fortitude Financial Group

What Does Fortitude Financial Group Do?

Table of ContentsThe 5-Second Trick For Fortitude Financial GroupUnknown Facts About Fortitude Financial Group5 Easy Facts About Fortitude Financial Group ExplainedNot known Details About Fortitude Financial Group

With the right plan in area, your cash can go better to help the organizations whose objectives are aligned with your values. A monetary expert can aid you define your philanthropic offering goals and integrate them into your financial plan. They can likewise advise you in suitable means to maximize your giving and tax obligation deductions.If your organization is a partnership, you will intend to go with the succession planning process with each other - St. Petersburg, FL, Financial Advising Service. An economic consultant can help you and your companions recognize the important elements in organization succession preparation, identify the value of business, create shareholder agreements, establish a compensation structure for followers, rundown shift alternatives, and much more

The key is finding the appropriate monetary expert for your scenario; you may end up engaging various advisors at different phases of your life. Try contacting your monetary institution for referrals.

Your following step is to speak to a qualified, accredited professional who can provide guidance tailored to your individual situations. Nothing in this article, nor in any associated resources, must be construed as economic or lawful recommendations. While we have made good belief efforts to ensure that the details offered was right as of the date the web content was prepared, we are incapable to ensure that it remains precise today.

The 9-Second Trick For Fortitude Financial Group

Financial experts assist you make decisions about what to do with your cash. Let's take a closer look at what specifically a financial expert does.

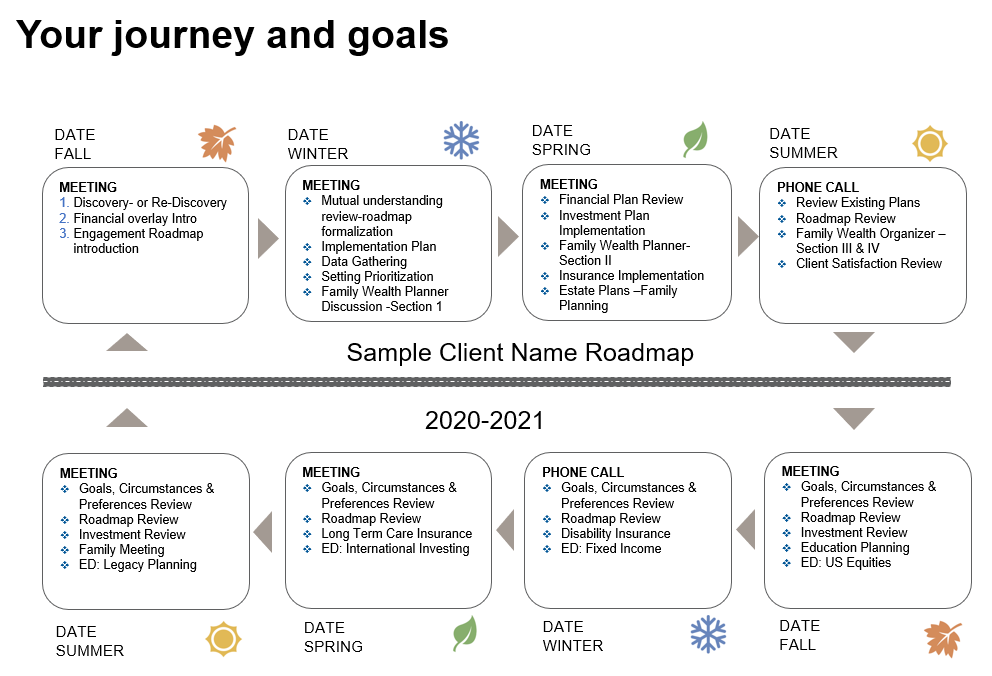

Advisors use their knowledge and experience to build tailored financial strategies that intend to attain the monetary objectives of clients (https://www.avitop.com/cs/members/fortitudefg1.aspx). These strategies consist of not only financial investments but also financial savings, budget plan, insurance policy, and tax approaches. Advisors additionally sign in with their customers regularly to re-evaluate their present scenario and plan accordingly

10 Easy Facts About Fortitude Financial Group Shown

To complete your goals, you may require a competent expert with the ideal licenses to help make these plans a fact; this is where a my response financial expert comes in. With each other, you and your consultant will cover many subjects, including the amount of cash you must conserve, the types of accounts you need, the kinds of insurance policy you need to have (consisting of long-term treatment, term life, disability, and so on), and estate and tax obligation planning.

Financial advisors offer a variety of services to customers, whether that's giving trustworthy basic financial investment suggestions or aiding in getting to a monetary goal like purchasing an university education and learning fund. Below, discover a listing of the most usual solutions supplied by financial advisors.: An economic expert supplies recommendations on investments that fit your design, objectives, and danger tolerance, creating and adjusting investing approach as needed.: A monetary consultant creates strategies to aid you pay your financial obligation and avoid financial debt in the future.: A monetary advisor gives ideas and strategies to develop budgets that help you satisfy your goals in the short and the long term.: Component of a budgeting strategy might include approaches that assist you spend for higher education.: Furthermore, a monetary advisor produces a conserving strategy crafted to your certain needs as you head into retirement. https://www.ted.com/profiles/47605164.: An economic expert assists you identify individuals or companies you intend to get your legacy after you pass away and develops a plan to perform your wishes.: A monetary expert provides you with the very best lasting solutions and insurance alternatives that fit your budget.: When it concerns taxes, an economic consultant might aid you prepare tax returns, optimize tax deductions so you obtain one of the most out of the system, schedule tax-loss collecting security sales, guarantee the ideal use the funding gains tax prices, or strategy to minimize taxes in retirement

On the set of questions, you will likewise suggest future pension plans and revenue sources, project retirement needs, and define any kind of long-term financial responsibilities. Basically, you'll detail all existing and predicted investments, pensions, gifts, and sources of income. The spending component of the survey discuss more subjective topics, such as your risk tolerance and risk capacity.

Fortitude Financial Group Can Be Fun For Anyone

At this factor, you'll likewise let your advisor understand your financial investment preferences. The first assessment might also include an examination of various other financial administration subjects, such as insurance coverage concerns and your tax situation.